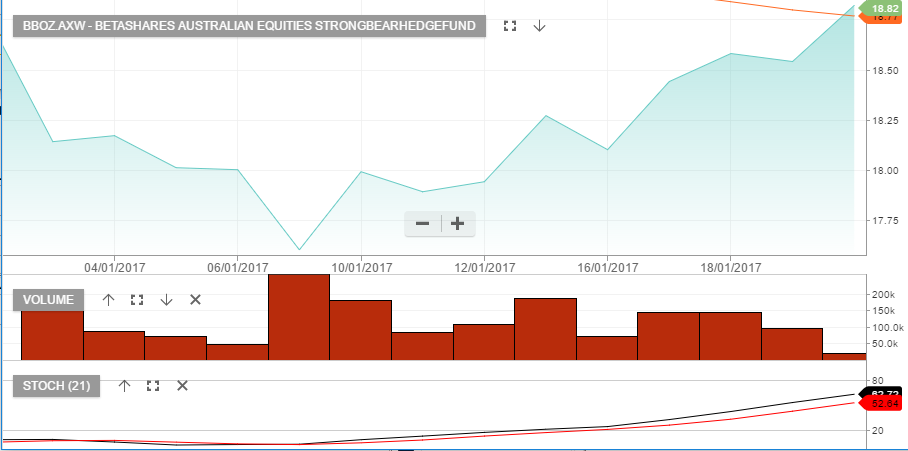

An inverse index ETF is an Exchanged Traded Fund which increases in value when the index trades lower. For portfolio hedging purposes, we use the ASX200 inverse ETF which is listed under the code BEAR. To hedge US stock exposure, we use an inverse ETF based on the S&P500.

Because of our concerns about inflated valuations in certain pockets of the global markets, we feel now is the time to draw our clients attention to these increasingly popular financial products.

Inverse ETFs are way of cost effectively hedging a portfolio and/or profiting from a move lower in Stock indexes