Here is a list of the first group of companies reporting where we’ll be reviewing the earnings results and keeping you informed….

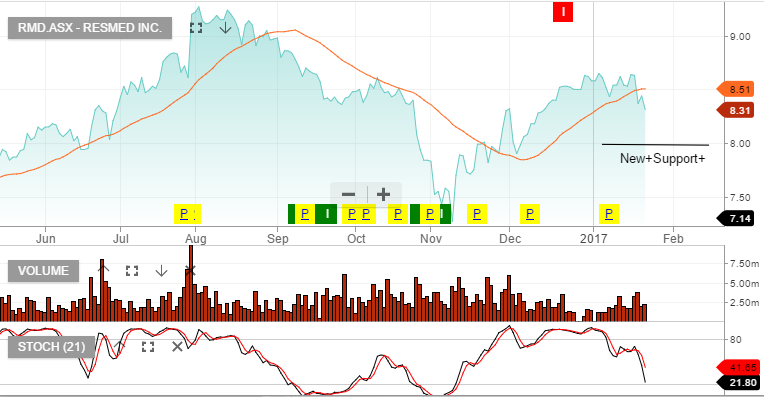

Resmed 24th Jan – Expecting better numbers following distributor de-stocking in the September quarter. New mask release should boost sales.

Tabcorp 2 Feb – Too early for any benefit from the Tatts acquisition, however, we’re looking for commentary on forecasts and cost savings.

James Hardie 2 Feb – US building cycle remains strong but we’re now cautious on James Hardie based on valuation concerns. Need to see EPS growth of 15%+

Transurban 7 Feb – We’re expecting strong free cash flow and minor dividend upgrades.

CIMIC 8 Feb – Expecting solid growth numbers and commentary on the integration outlook of UGL following the recent take-over

RIO 8 Feb – Good production numbers and we expect earnings to meet consensus forecast.

AGL 9 Feb – We’re concerned the market is too optimistic here and we will be looking at this result closely.

AMP 9 Feb – After the downgrades from the under-performing life insurance, we question what the future earnings look like. AMP as an asset manager is a very attractive business, we just need to re-establish the expected EPS growth rate.

Amcor 13 Feb – Looking for confirmation of 8% EPS growth

Ansell 13 Feb – FX impact could be a minor negative but the underlying business is improving. We’re looking for detail and timing on the pending corporate restructure strategy.