Over recent weeks, we’ve highlighted a number of stocks that are overvalued and susceptible to any increase in market volatility or risk-off period.

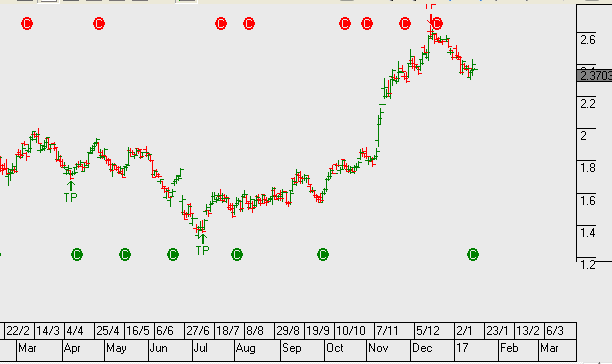

Stocks that have rallied due to higher US interest rates are starting to retreat as the yield on the US10-YR starts to slip lower from the recent 2.64% high. Companies affected in this group include Computershare and QBE.

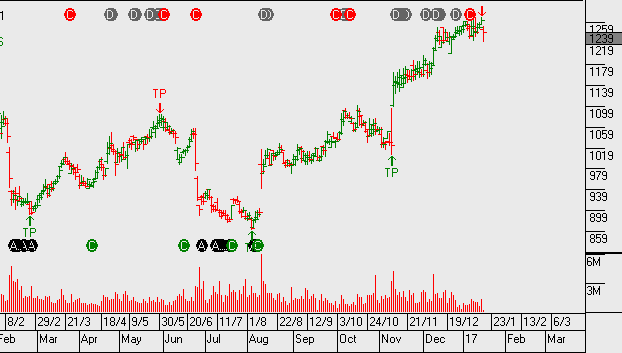

Australian Banks are beginning their sell-off and our bank hedge is starting to pay-off.

Exiting property plays, especially where there’s development risk will likely prove worthwhile in the coming months. We’re happy to stay exposed to the best-of-the-best only in this space and sell tight covered calls.

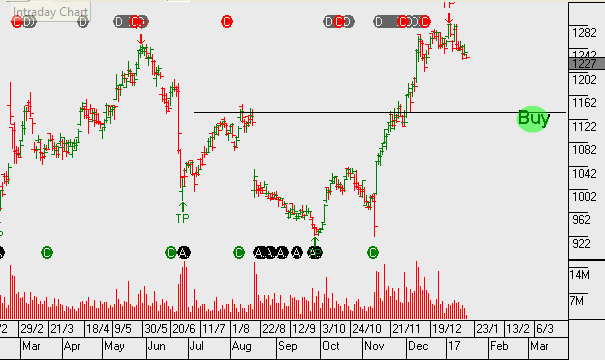

The issue we see is that the US bank results out so far, is probably as good as it gets for US 4Q earnings. Over the next two weeks, multinationals, industrial names and then big technology will announcement their results.

If we see an average EPS run rate for the S&P500 that fails to meet the $132 per share expectations, and in fact averages somewhere in the range of $120 – $125, then the Dow Jones will struggle to move higher.

With the above in mind, we’ve been making adjustments to portfolios to hedge an uptick in volatility and deliver returns through an aggressive derivative overlay.