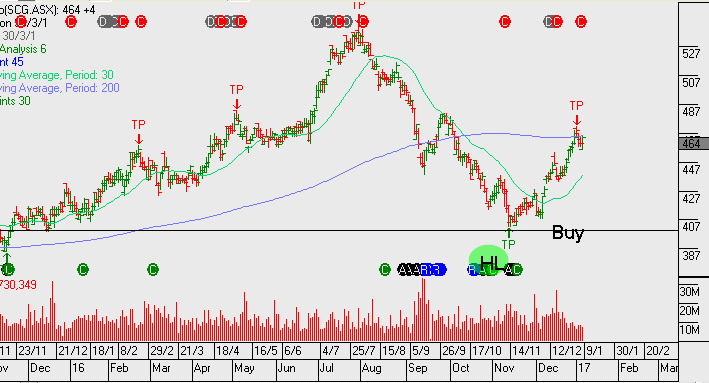

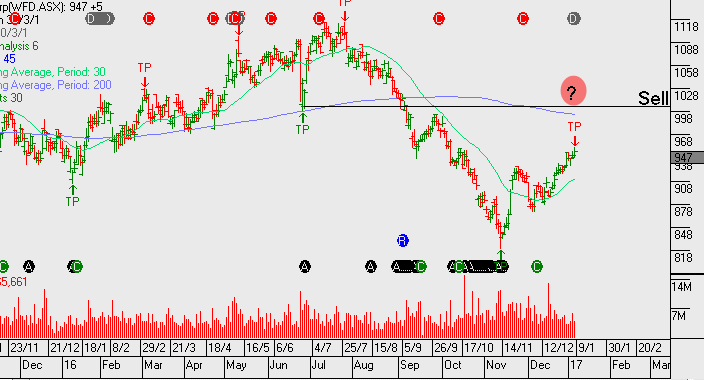

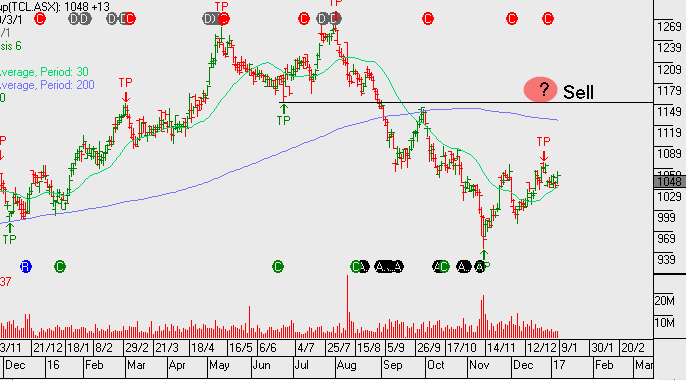

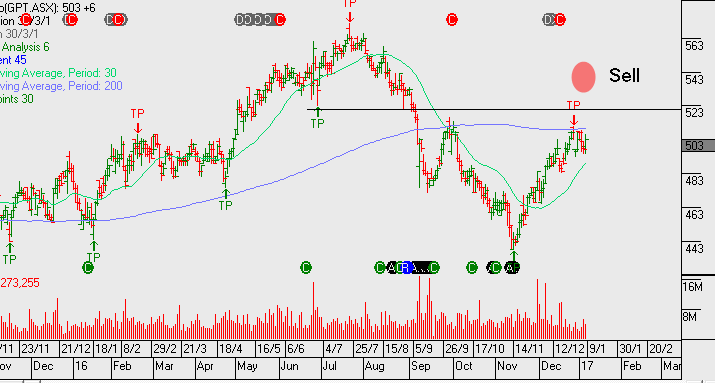

In late 2016 we began highlighting yield names which were oversold and were likely to bounce back coming into the year end. Our preferred names in the yield basket were WFD, SCG, GPT, SYD and TCL. On average, these names have rallied over 10% from their November low.

The consolidation of US yields, (bond prices no longer falling & yields no longer moving higher), along with the oversold condition in our domestic yield sensitive companies, were enough to generate the rally.

From here we feel these names will remain supported, especially if volatility picks up in the broader market during the Jan – March period. With this in mind, we continue to hold our yield basket and overlay covered calls to boost the cash flow to 10%+ on an annualised basis.