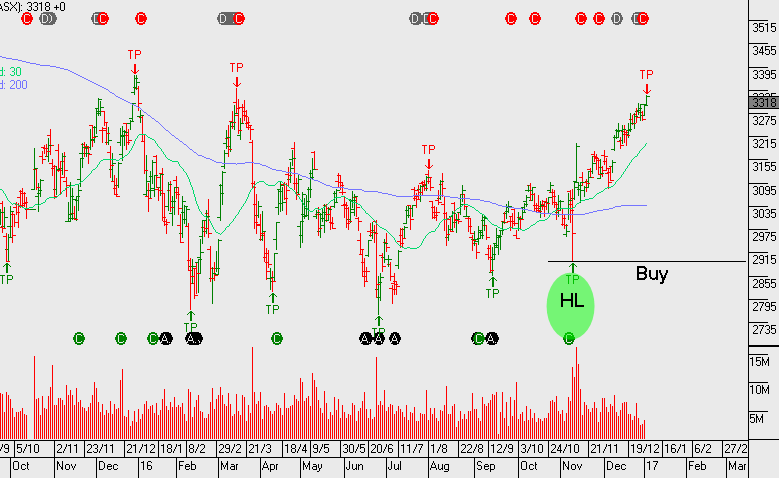

Currently, ASX leading Financials are being dragged higher as the US equity rally continues into the lead up to their fourth quarter earnings results. We’re somewhat sceptical of the valuation support and yesterday started hedging our banking exposure in client portfolios. This was done through using in-the-money European-style calls over CBA and slightly in the money February calls over NAB, as two examples.

In the case of CBA, we stay exposed to the February dividend and franking credit but have hedged a price pullback of up to 5% between now and March.

In NAB, we’ve hedged to a similar extend but without the need to protect the dividend. NAB’s next payment period is not until May