Over the past two months, the Chinese Interbank Funding market has come under structural pressure as the Government has introduced changes to domestic capital control regulations. The goal of these changes is to stem the flow of Yuan leaving the country.

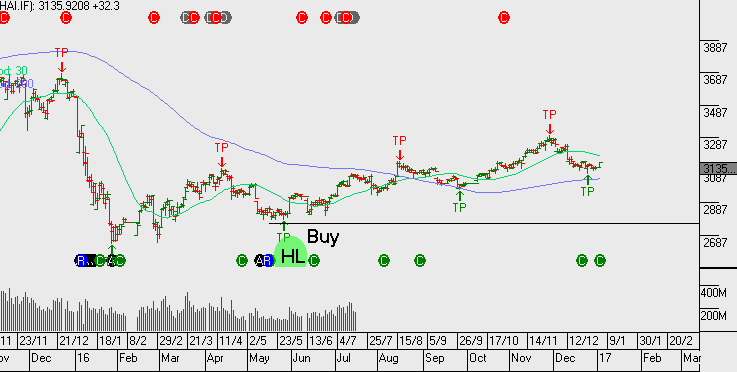

An unintended consequence of these new capital measures has been acute liquidity shortages in the secondary bond markets, which have triggered two trading halts over the last month. The chart shows how the 2-year swap rates have surged higher as uncertainty about future funding lines has seen overnight lending rates gyrate between 3.5% to 17.00% over the last 60 days.

The primary concern for Australian investors is how this bond market instability could impact Australian exports of raw materials, consumer goods and agricultural products to the mainland. As a knock-on effect, the Shanghai Index has lost over 4% over the last month and the Chinese Yuan pricing has increased in volatility…….neither of which were intended goals of the new capital measures.

We will continue to monitor developments in the Chinese market and pass along any trade suggestions which the may be triggered from the Algo engine.