Shares of the Commonwealth Bank (CBA) posted a new high for the year at $82.65 as the bank announced it has sold its remaining stake in the US financial services company, Visa Inc.

The CBA sold its stake in Visa for A$439 million, realizing a post-tax profit of A$278 million. Against this profit, CBA has also announced a one-off accelerated amortization on certain capitalized software assets, totalling A$275 million.

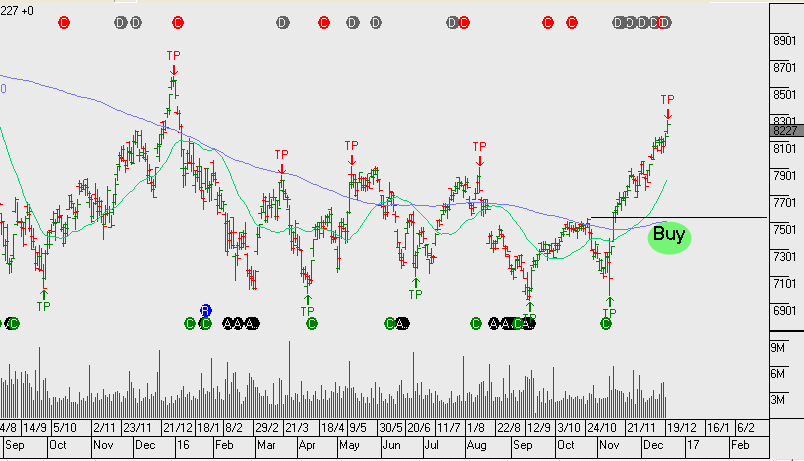

While the accelerated amortization is more than offset by the profit on the sale of the bank’s Visa holdings, we see this move as reducing the potential for earnings uplift going into 2017. As such, heading into the February dividend, we see price resistance at or near the $83.00 level.