Political events and Central Bank policy moves have been driving global financial markets over the last two months. During this time, direct influence from weekly economic data seems to have diminished. With dealing desks starting to thin and investors looking to the holidays, this is likely to remain the case over the next two weeks.

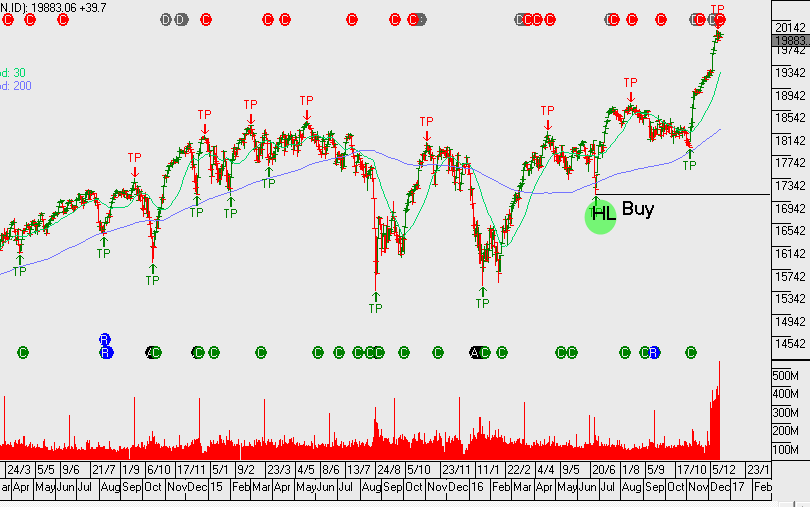

But even as financial markets slip into holiday mode, there are several powerful trends that are worth watching. Three of these trends have been particularly vigorous: The USD climb against the JPY, the rise in the US 10-year yields, and the rally in the SP 500 have all been very robust. In fact, these three markets have risen six weeks in a row and finished higher over nine of the last 11 weeks. Similarly, the USD Index and US 2-year yields have risen, while Gold has fallen, in seven of the last 11 week.

The key issue now is whether these trends will be extended, or if a profit taking phase will be seen into the end of the year. Arguments that these trends have gone too far too fast are now several weeks old. And even though technical readings are even more overstretched, there aren’t reliable fundamental arguments for taking aggressive positions in the opposite direction……….not yet, anyway.

The basic psychology of these recent trends suggests the new US administration will act swiftly to enact a comprehensive (fiscal) stimulus package; which will allow US stock valuations to expand and the US Dollar to appreciate vis-a-vis higher domestic interest rates.

On balance, we expect the current trends of higher US stocks, firm US Dollar and a steepening yield curve to continue, even as market flows edge into holiday mode.