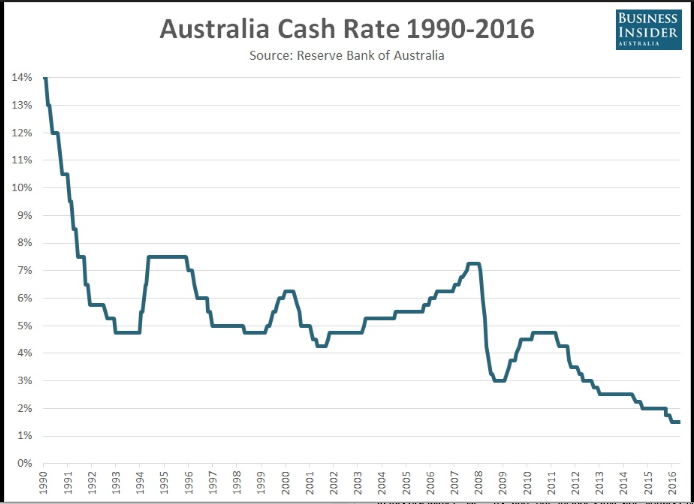

The RBA will hold it final meeting of 2016 today with their announcement scheduled for 2:30 pm Sydney time. All 26 economists polled by Bloomberg have the cash rate remaining unchanged at 1.5%, while the financial markets reflect only a 2% chance for a 25 basis point cut.

Given these expectations, any market moving news will come from the wording of the of the accompanying monetary policy statement which could provide clues as to the policy bias of the RBA board.

In particular, financial markets will be focusing on the language used towards the housing and labour markets, as well as the board’s outlook on inflation.

Of these three areas, housing and labour have shown mixed results since the last RBA meeting: there has been a noticeable acceleration of housing loans, but a sharp fall in building approvals. Similarly, New Job ads have increased, but employment growth is heading in the opposite direction.

The recent wage price index report, which recorded its slowest increase on record for Q3, will likely keep inflation expectations in the lower end of the RBA’s target band.

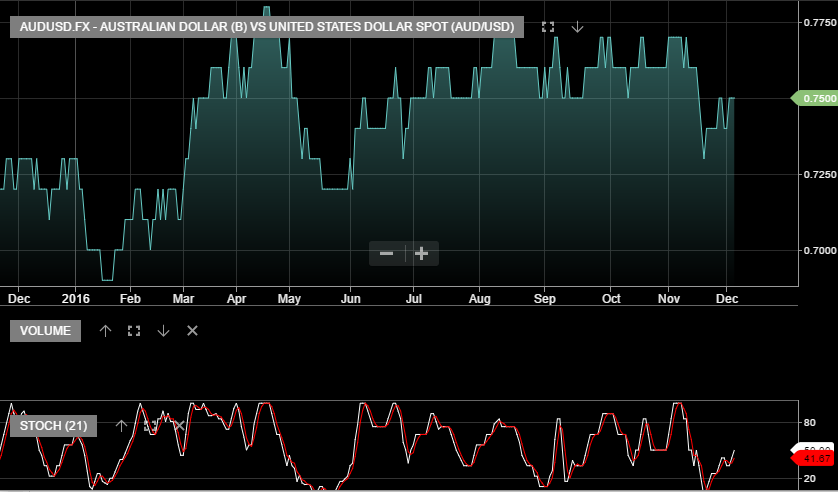

On balance, we expect the RBA to remain unchanged with a slight shift to a more “Dovish” bias going into next year. This stance should be supportive for stocks, in general, and slightly negative for the Australian dollar.