Global Macro

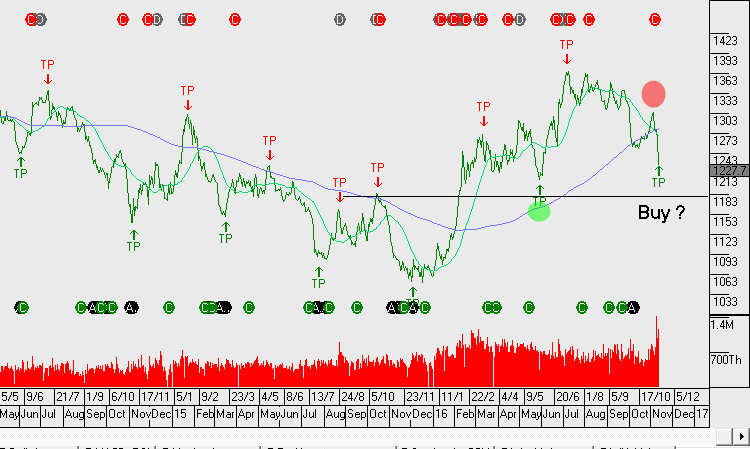

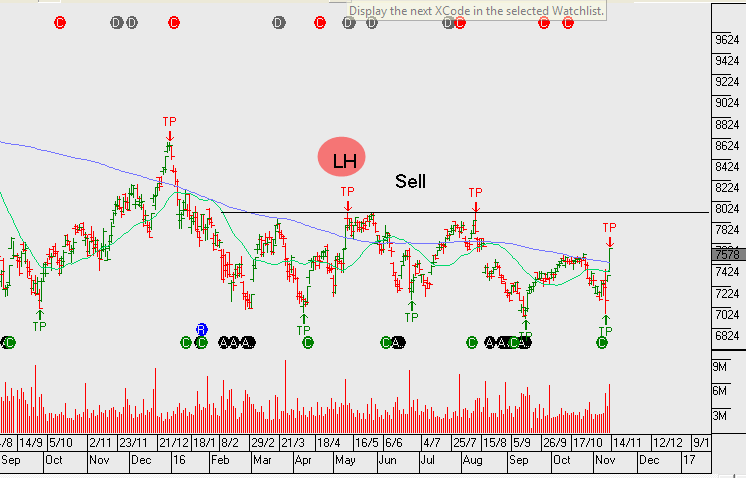

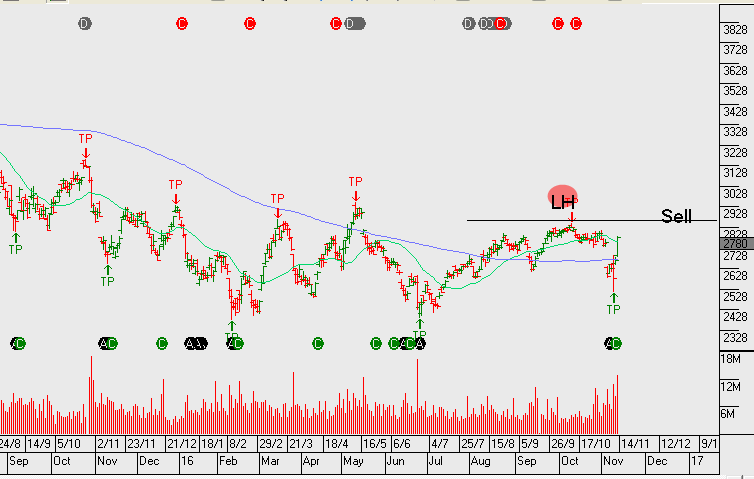

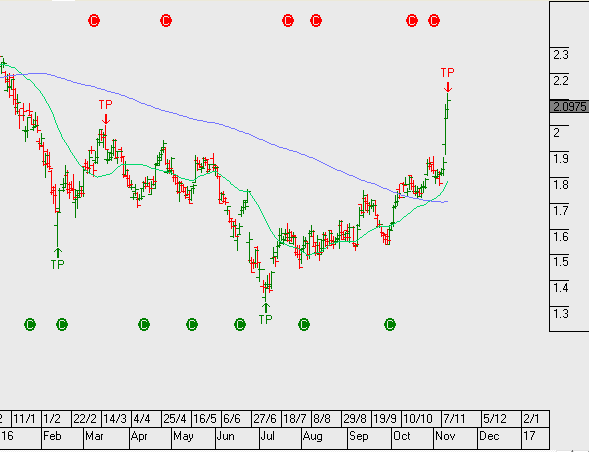

Following Mr Trump winning the election and Mrs Clinton accepting the result, bedlam broke out in the financial markets midway through the Asian timeframe: the USD was sold off across the board, Gold rallied $60.00 to $1,335.00, the SP 500 fell limit down to 2030, bond yields plunged 15 basis points and the Mexican Peso made a new all-time low at 20.75.

However, just as the London dealers were rolling up their sleeves, calculating potential margin calls and preparing for a financial blood bath, the market dynamic changed. The catalyst of the market stabilization and subsequent rally appears to be two-fold: 1) Mrs Clinton called Mr Trump to concede defeat (which meant no chance of a protracted legal challenge) and 2) the market started pricing in the reflationary aspects of some of Mr Trumps campaign promises.

The cornerstone of his general economic plan has been the initiation of a massive infrastructure package. However, the market was caught off-guard by the announcement that part of the package would be funded by a tax concession to US corporations holding US Dollars off shore.

It’s estimated that up to $2.9 Trillion of corporate profits are being held off-shore by US companies unwilling to take the 35% profit tax charge to repatriate the money. These multi-national companies include General Electric, Apple, Microsoft and Intel……all of which have more than $100 billion parked overseas.

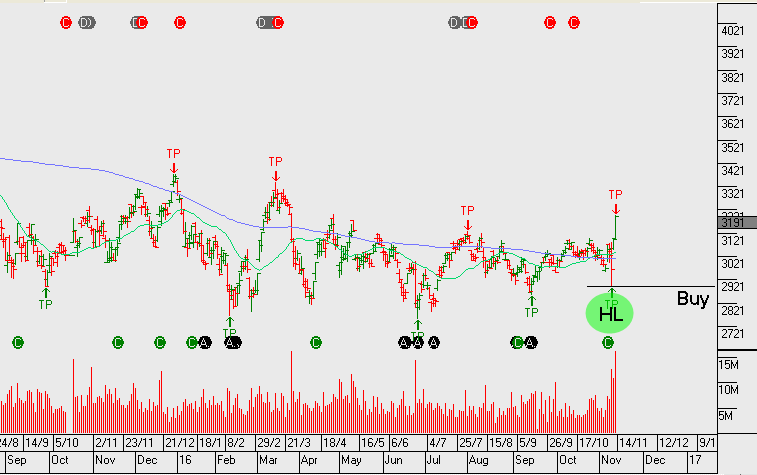

As the news of this proposed tax reform/amnesty plan circulated through the market, infrastructure names, heavy construction companies and stocks of military defence contractors all rallied higher. Whether or not this grand plan ever makes its way into the US economy will be determined on another day.

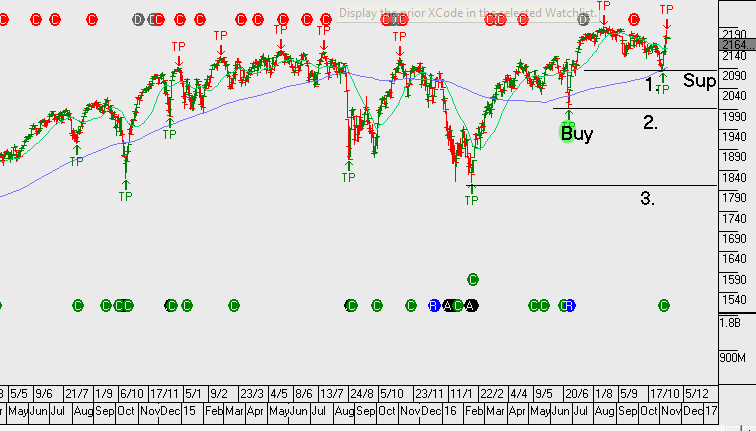

But as the US market heads into the three-day Veteran’s Day holiday, the USD Index is back over 98.50, US 10-yr yields are over 2.15% and the SP 500 is poised for its strongest weekly gain in over two years.

Next week the market will focus on data from the EU and Japan, but for now, global risk assets are satisfied that the transition of Presidential power will transfer smoothly and that Mr Trump is going focus on the economy first.