Amcor – Price Target Update

The recent rally from $13.60 to $15.00 may be the best upside performance we see in Amcor for a while. Some analysts are downgrading Amcor from “outperform” to “neutral” as the company’s defensive revenue stream isn’t likely to expand as higher global interest rates affect their expense line and cost of capital calculation. This includes the impact of the USD appreciation against the EURO lowering EPS by about 5%.

With its large US and European asset base, Amcor has been able to maintain lower borrowing costs. However, with Weighted Average Capital Costs, (WACC), increasing from 6.6% to 7.1% in FY 17, bottom line profit growth may not be able to keep pace with rising interest rate.

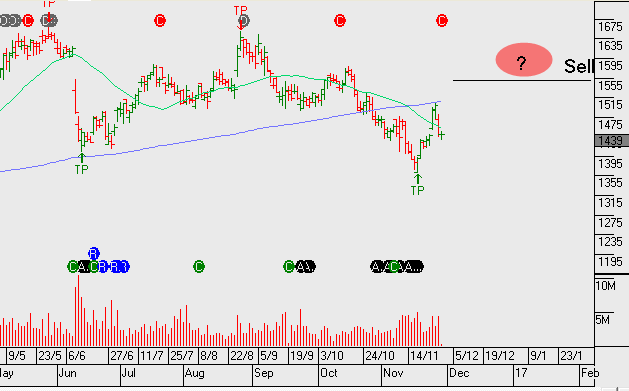

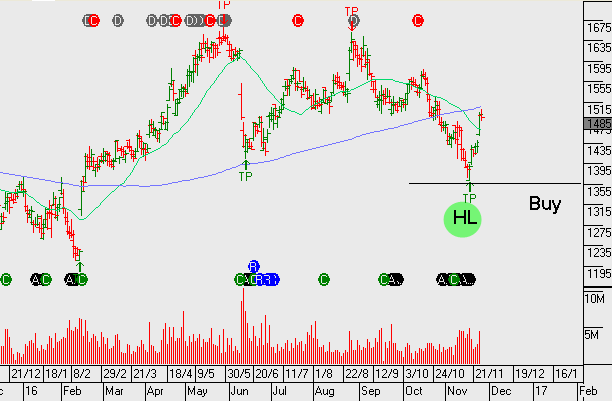

We see the price impact reflected in the lower high and lower low technical structure in the Amcor chart. Whilst we don’t expect aggressive upside share price targets, we still feel owning AMC and selling covered calls to generate 10% annual cash flow from the dividend and call option premium makes sense.

The trading range is now $14 to $15.50 and investors should consider locking in gains at the top of the range, (or delivering the stock under the call option at $15.50 strike) and looking to buy the stock back on any pullbacks to $14.00.