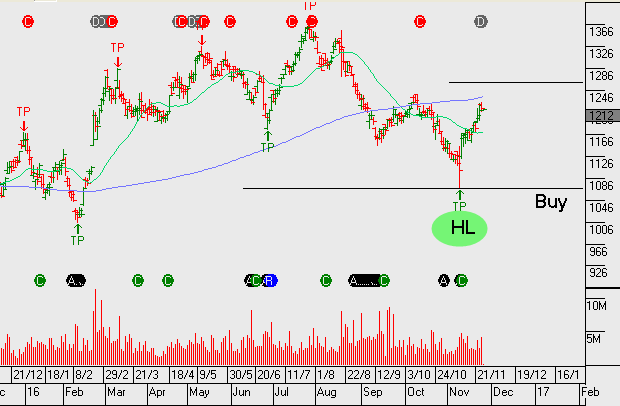

We’ve been buyers of BXB on the recent low and are now mindful the stock has rallied almost 10% from its lows and on a valuation basis the share price is likely to run into selling pressure around $12.50.

At $12.50 it places BXB on a forward yield of 2.5%, assuming management delivers 8% underlying EPS growth. From a technical perspective, the algo engine is now flagging the lower high formation which we take as a signal to either lock-in short term profits, or for longer term holders, sell covered calls to enhance the cash flow yield.