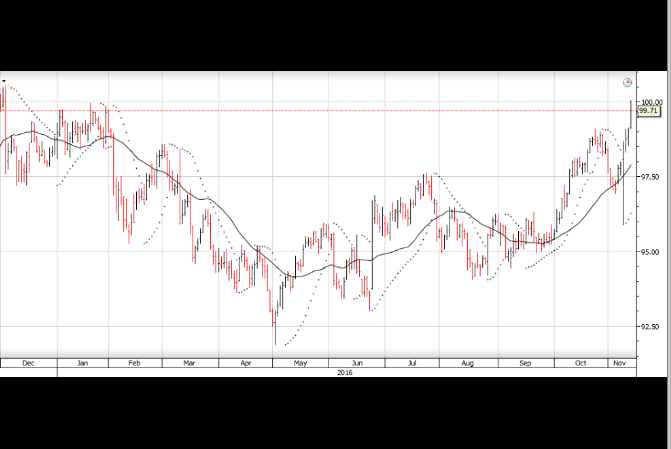

Since the Global Financial Crisis in 2008, one of the most consistently followed market correlations has been …. how the value of the US Dollar influences the price of base metals and industrial minerals including Coal, Copper and Iron Ore.

Over the last eight years, from a basic “cause and effect” standpoint, as the US Dollar appreciated against the basket of G-7 currencies, the price of Coal, Copper and Iron Ore declined; and vice versa.

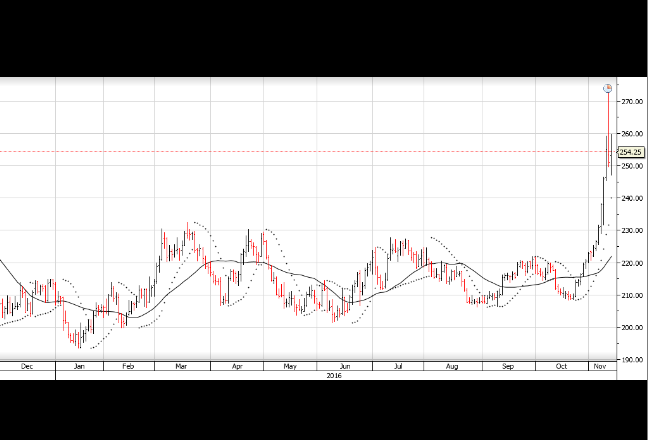

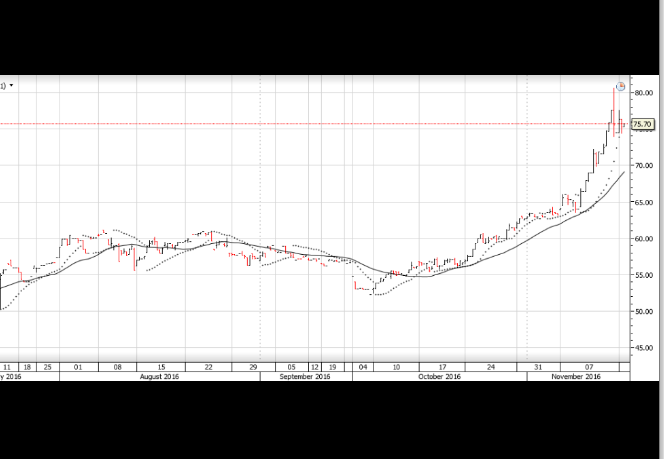

However, over the last 45 days, this correlation has soften materially. During this period, the price of Comex Copper has rallied from $2.10 per pound to $2.60 per pound; a gain of over 23%. Similarly, over the same timeframe, the price of Iron Ore has risen from $63.00 per ton to $76.00 per ton for a 20% gain, and the price of Coal has lifted over 11% from $41.00 per ton to $45.50 per ton.

This has all occurred while the USD Index has traded just over 4% higher from 95.50 to 99.50.