Westpac 2H16 earnings result was in-line with market expectations and the dividend was maintained. 2H16 cash profit came in at $3.9b and DPS $0.94 with a payout ratio of 80%. ROE has fallen from 15% to a target of 13 – 14%.

Revenue growth was slightly negative which has been the case across most of the recent banking results.

FY17 outlook is for revenue to remain flat and underlying profit to be 3% higher at $12.6b, on EPS of $2.38 and DPS of $1.88 placing the stock on a forward yield of 6.3%.

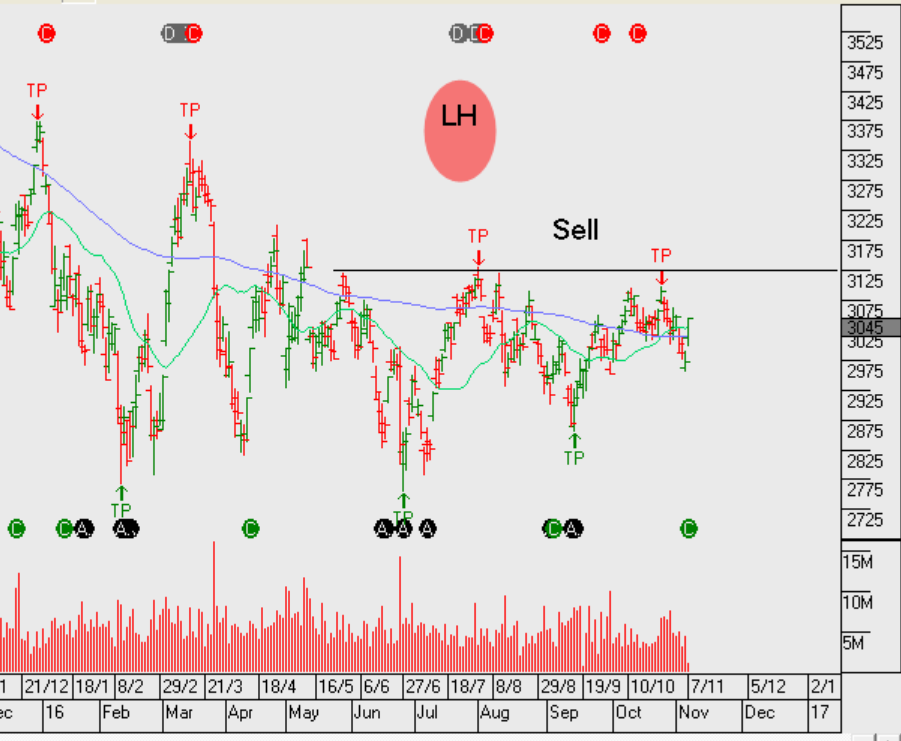

We’re running covered calls over the bank holdings to enhance returns in what we see as a low growth environment.