Shares of Facebook are down close to 8% in after-market trading to $117.00 even though the social media giant reported quarterly earnings that beat analysts expectations.

The company announced adjusted earnings of $1.09 per share on revenue of $7.01 billion, up from the comparable year-ago figures of 57 cents per share, adjusted, on $4.5 billion in revenue. Analysts were expecting 97 cents per share on revenue of $6.92 billion.

Advertising revenue was announced at $6.82 billion, above the $6.71 billion consensus estimate. Monthly active users rose to 1.79 billion and signalled the first time more than 1 billion users were active on their phones in a month.

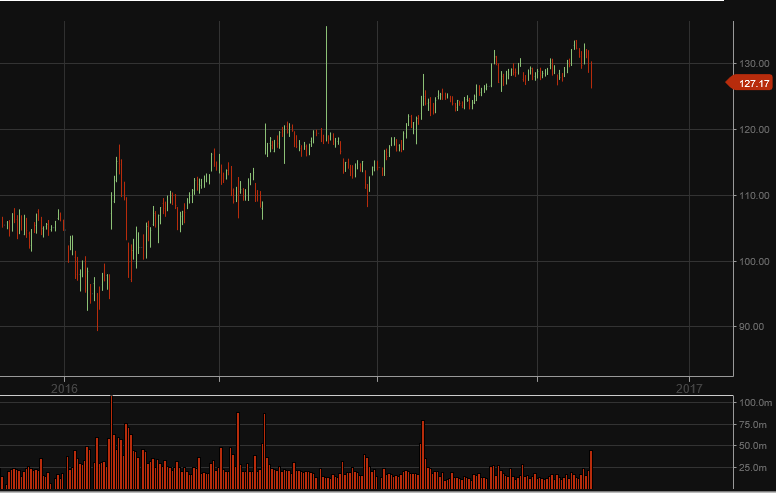

However, share prices fell sharply after CFO David Wehner said the “ad load”, or number of ads on the website, could come down meaningfully after mid-2017 which could impact revenue growth in Q4 2017.

The next support level in the share price will be found at the double bottom price at 108.50 last traded in April and June.