Resmed reported 1Q17 results with adjusted NPAT of $88 million or 3.6% growth on the same time last year.

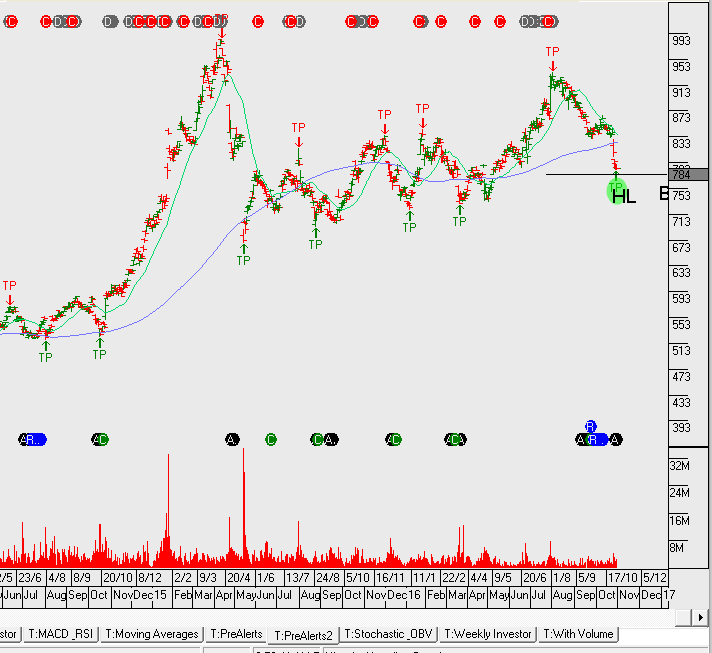

While the improving gross margin is a positive sign, it’s difficult to equate RMD’s 3% organic growth in the first quarter with its recent FY17 multiple of 22x earnings. The recent pull back in the share price to $7.85 could relieve some of this P/E imbalance.

We look to add to the RMD position on the current pullback. A rally back above $8.25 will provide an opportunity to sell covered calls.