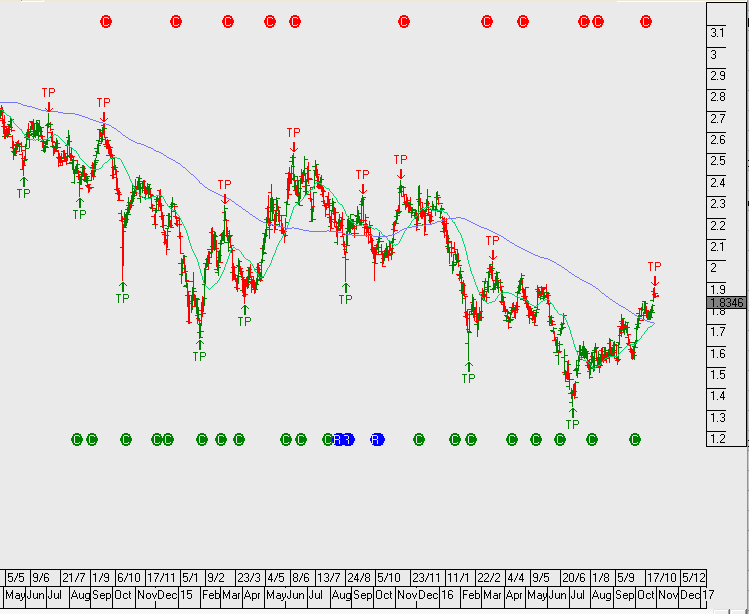

Over the last six months, an overarching theme driving G-10 financial markets has been the divergence in interest rate policy trajectory between the US Federal Reserve and the rest of the group. From a “cause and effect” point of view, US economic data has been viewed through a prism of how it could influence policy decisions from the FOMC, which has then impacted the way G-10 assets respond relative to US assets.

In short, key fundamental data points which print better than expected have been bullish for the USD and bond yields, and economic reports which reflect weakness in the US have been bearish for the USD and bullish for US stocks. However, last Friday’s trading session illustrated how these correlations will likely be suspended until after the US Presidential election on November 8th.

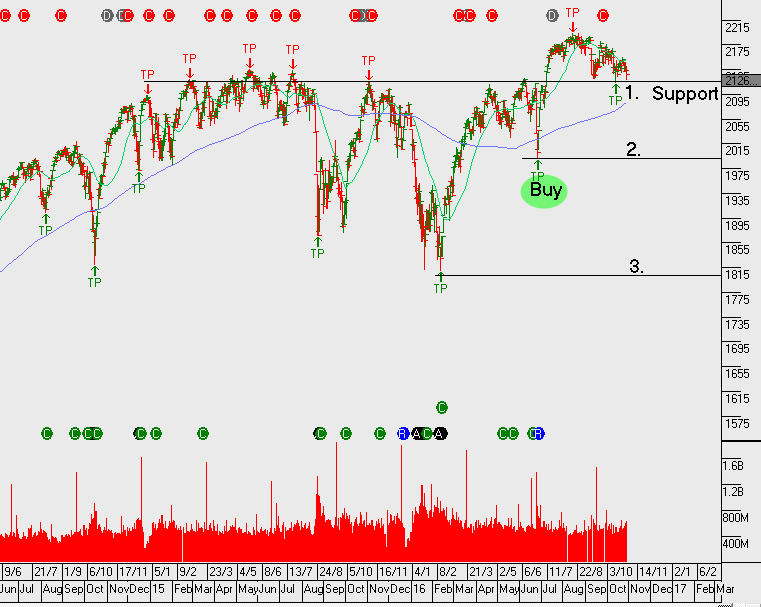

Friday’s NY trading session began with the release of the highest Advanced GDP report in two years. As expected, the USD Index rallied to a 9-month high just under 99.00 and the EUR/USD slipped to the low end of the range near 1.0850. At around 1:00 PM, NY time, news hit the wire that the FBI said it would reopen its investigation into Hillary Clinton’s private e-mail server after new evidence was discovered on other electronic devices in an unrelated case. The market acted swiftly as the EUR/USD jumped 90 points, bond yields fell and the SP 500 dropped 20 handles from 2140 to 2120 before recovering.

We won’t discuss the validity of the FBI’s decision. However, from a market participants point of view, the important thing to note is that anytime there’s an opening for Don Trump to close the polling gap it means more uncertainty on the horizon and less chance of a rate adjustment this December from the FOMC. As such, we will offer to explain some of the dynamics we could be up against over the next several trading sessions.

It seems the market’s fear of a Trump victory is focused on his proposed tax cuts leading to higher deficits and a steeper yield curve. Some other analysts believe his trade policies could trigger a sell-off in equities and a flight to quality into the long-end of US Treasuries.

Using the “Brexit” vote as a point of reference, a Trump win could trigger a sharp rise in volatility in bonds, FX and equities. And while the spike in asset volatility was short-lived as the VIX moved back to pre-Brexit levels by early July, the impact on the yield curve lasted much longer. The UK referendum was on June 23rd, and it took until mid-September for the UK 10-year Gilt yields to rise above their pre-Brexit levels. There is a similar fear in the US Treasury market if Don trump wins.

In this respect, it’s our view that this week’s fundamental news (which includes 3 Central bank meetings and European PMI’s) will take a back seat to the re-pricing of last week’s forgone conclusion that Hillary Clinton will win the US election.