With the prospect of a “hard Brexit” becoming a reality, market participants who had expected a “soft” Brexit, or no Brexit at all have had to adjust their UK price forecasts. The Sterling, for example, has depreciated more than 5% against the G10 currency basket over the last week and some analysts are calling for a drop to parity against the USD by the end of the year.

Going back to late June, the GBP depreciation was considered beneficial for the UK following their decision to leave the EU. The orderly decline in the Sterling, alongside the easing of monetary policy and decline in 10-yr Gilt rates, would serve as an economic cushion to keep exports and equity prices steady while trade deals with other EU nations were being negotiated.

However, the recent down move in the GBP has not been orderly, nor has it coincided with lower yields across the UK Treasury curve. The 10-year Gilt yield has risen more than 20 basis points over the past week as the GBP/USD has dropped over 600 points. Granted, G-7 Treasury rates have risen across the board but nothing like the UK rates. The 10-year yields in the US and Germany have risen by 8 and 7 basis points, respectively.

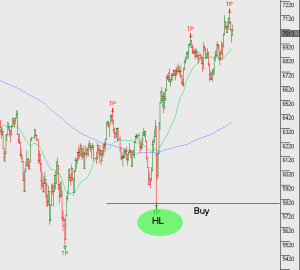

In the equity market, the FTSE 100, which is now viewed as a currency play given the heavy weighting of companies that rely on foreign earnings, has returned over 13% for domestic investors this year, but has lost close to 7% for unhedged USD-based investors over the same period. Further, the return on the broader FTSE 250 is even worse with domestic investors up 3.2% and USD-based investors down 14.5% during 2016.

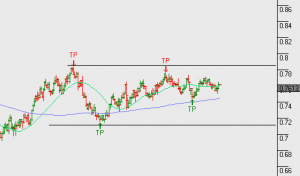

On balance, we believe it’s reasonable to expect that the uptick in yields and recent political developments will support the Sterling while carving out a base above recent lows. The GBP/USD has rebounded over the last two sessions. The recovery has been fuelled by UK Prime Minister May’s concession to allow Parliament to vote on the Brexit decision. Hearings before the British high court will continue until Monday, which could delay the process of when Article 50 is invoked.

The AUD/USD fell sharply after yesterday’s weaker-than-expected Chinese trade balance reports.

AUD/USD

FTSE 100