Today’s NY close will mark both the end of September and the end of the third quarter of 2016. Often times, these month-end, quarter-end trading sessions can see broad reversion moves within long worn price ranges. With the UK current account data scheduled for release today, could month-end flows lift the Sterling into the weekend?

Doing a straight quarter-to-quarter price analysis, the GBP/USD looks overdue for a substantial recovery. The pair started Q2 of 2016 at 1.4250 and started Q3 more than 10 big figures lower at 1.3225. Over the last couple of months, the GBP/USD has been trading in an inverse pennant formation bound by the 1.2850 level on the downside and finding resistance just under 1.3500.

During the same period, the FTSE 100 has gained just over 4%, which illustrates a combination of over expectations of widespread asset devaluation post-Brexit and the re-pricing of growth assets relative to the lower Sterling.

The UK balance of payment report is first-tier data set and has been heavily influenced by the sharp devaluation of the Sterling since the June 24th referendum. Market forecasts are calling for a contraction of the trade deficit from – £32.00 billion to -£30.00 billion. And while seeing the deficit shrink by 2 billion quid may not appear to be a large improvement, it’s still materially better than blowout numbers predicted by Brexit opponents.

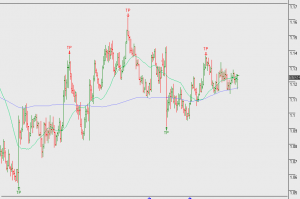

Chart – FTSE

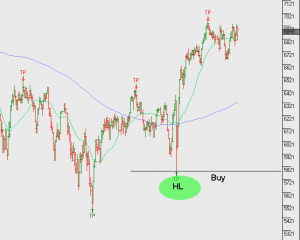

EUR/USD

EUR/USD