US Macro

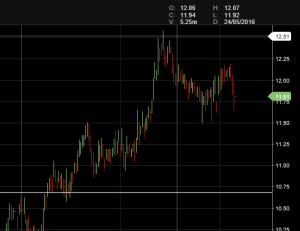

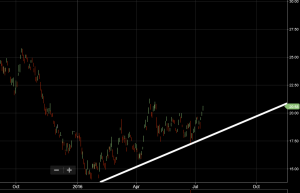

In the days following the June 23rd UK referendum, many FX market forecasters suggested the Sterling would fall sharply, perhaps even breaking below the 1.2000 handle against the USD. While these predictions may turn out to be correct, the GBP/USD has pretty much gone vertical since posting a 1.2850 low on Monday.

And even though the consensus for the Bank of England (BoE) to cut rates yesterday was just slightly above 50/50, the GBP/USD traded sharply higher after the after the BoE voted 9 to 0 to leave rates unchanged. However, with most policymakers seeing a rate cut in August, the Sterling remains a sell into this recent reversion.

The Sterling’s reaction to yesterday’s BoE pause at .50% was an illustration of misplaced Central Bank expectations. The financial media was calling for a cut down to .25%, many FX traders believed them and when the BoE kept rates unchanged, the GBP/USD soared from 1.3250 to 1.3475 in less than five minutes……and then faded as the session progressed.

According to the minutes from the meeting, the BoE has been satisfied with how UK financial markets have functioned post-referendum but there are some indications that businesses are delaying investment and hiring so economic aggregates are likely to be depressed in the near term. It’s worth noting that in addition to cutting rates, the BoE minutes discussed a “range of possible stimulus measures.” We interpret this to mean a possible increase to Quantitative Easing in August.