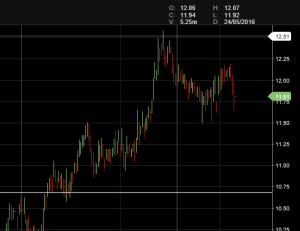

Long TCL.ASX

TCL reported 4Q16 traffic – trend remains positive for NSW, some softening is emerging in Melbourne and Brisbane. FY16 Proportional revenue across Australian roads was $1.7 billion. Look for FY17 dividend to increase from $0.45 in FY16 to $0.50 in FY17. This places TCL on a forward yield of 4.2%.

TCL is close to full value short term (12 month outlook) and should be complemented with a $12.70 covered call into March. We’ve collected an additional $0.50 for this call option and we expect to remain exposed to the $0.22 cent dividend in December. This trade allows for some capital gain if exercised. If TCL trades sideways, a combination of the dividend and the call option income creates approximately 10% cash flow on a stand still basis.